Two companies founded on security and privacy are partnering to make online payments quicker and safer. Password manager 1Password and virtual card platform Privacy.com announced an API integration that lets users create virtual cards in their browser quickly and safely when they need to make a payment.

The FTC reports that credit card fraud is by far the most common type of identity theft, occurring in 41.8% of all identity theft reports. According to Javelin Strategy & Research, which advises card issuers on security banks, merchants and cardholders lost a combined $16.9 billion in 2019 due to credit and debit card fraud.

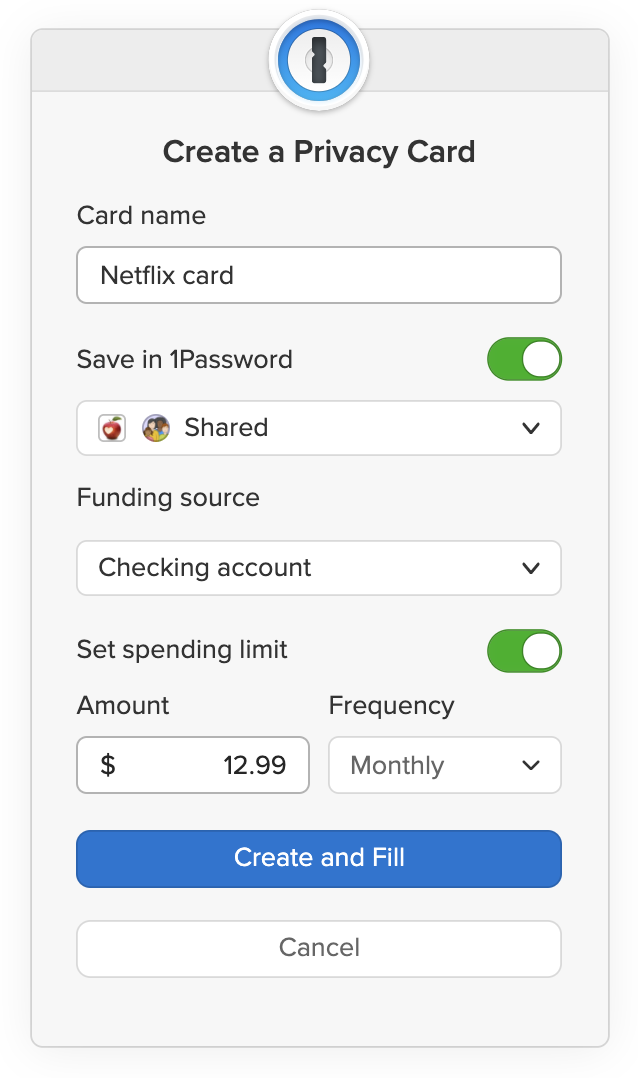

Privacy.com’s virtual cards mean users never need to share their credit or debit card information online, helping to protect both their money and their identity. Starting today, users can create, use and save Privacy Cards directly within their 1Password extension whenever they’re needed.

All virtual cards created in 1Password will have the same security benefits as other Privacy Cards – users can set monthly or annual spend limits, create single-use or merchant locked cards, and pause or unpause cards whenever they want.

“Partnering with Privacy.com is a no-brainer for 1Password,” said 1Password CEO Jeff Shiner. “We share a total commitment to online safety and privacy, and our goals couldn’t be more aligned. These are brand new features both for password managers and payment services, and I know both teams are excited to be bringing these new capabilities to our customers.

“What I’m happiest about is that this helps everyone, from our family customers right up to the largest enterprises. With the Privacy.com integration for 1Password, you can make payments online with more safety and privacy, whoever you are.”

“It’s the first time users will be able to generate virtual cards directly within their password manager, cutting down on the number of steps needed to protect their payment credentials,” said Privacy CEO Bo Jiang. “This simple and seamless integration demonstrates the breadth and power of both of our APIs.”

User benefits of 1Password’s partnership with Privacy.com

- Easily create new Privacy.com virtual cards. When users are asked to enter a card number on a vendor’s site, 1Password will give the option to create and name a virtual card instead.

- Set spending limits. When creating the card, users can set spending caps for a one-off payment, monthly or annual limits, or a total amount. In addition to enterprises capping expenses, consumers can, for example, create a “Spotify” card for monthly subscription payments or an “Amazon” card with a spending ceiling.

- Unique cards for each merchant. Cards can only be used at a single site or service, so if the card details are ever exposed in a data breach, they can’t be used elsewhere.

- Save card details in 1Password. When creating a card, users will have the option to save it in 1Password. Then, when it’s time to enter payment details, 1Password will show users any cards associated with that particular website. It’s also a quick and easy way to grab a CVV number when needed.

- Enterprise grade. Combined, 1Password’s enterprise password manager (EPM) and Privacy.com now give enterprises greater financial safety and control.

By limiting cards to vendors and setting spending limits on those cards, users are better protected from online fraud, data breaches, overcharges and subscription scams. If the card details were ever exposed in a website data breach, the card would be instantly blocked if used anywhere else.

Meanwhile, enterprises benefit from virtual cards for a range of tasks, from managing and tracking vendor transactions to setting spending limits on employee expense accounts.

The service and integration will initially be available in the US. To get started, users can set up the integration from their Privacy.com settings. It’s available right away in 1Password’s browser app, 1Pasword X, with support in the 1Password Safari extension coming soon.

from Help Net Security https://ift.tt/331eB5U

0 comments:

Post a Comment